In this video, you’re going to learn what a W-2 really is, how to read it, and what you should to about your withholding taxes.

Here is a link to the latest W-2 Form from the IRS so you can follow along:

Think back to your first job or think about the first job you’re going to take. You may be a mom entering the work force at the age of 40, you may be a college student, or you might even be a high school student who is about to get their first job at the local business in your area.

I’m going to tell you about my first job experience at 17 and see if you don’t feel the same way. I had just finished high school and I had borrowed money to get through my senior year of high school for tuition, actually my mother borrowed the money from a coworker.

I needed to go to work to pay that back. So I found a job at a pharmaceutical company in Los Angeles; I was hired as the inventory controller.

So, they gave me paperwork to fill out that you would know as a W-4. The W-4 states if I am single, married, single with children, single with no one, married with just a spouse, or married with children. And it asks you for that because the government has a rather complicated formula to figure out how much tax will be deducted from your check.

I really didn’t understand that tax would be deducted from my check. I was hired at $300 per month. Which meant that I would get 2 checks a month of $150 gross(remember the term gross, because the difference between gross and net is where all those taxes are).

I think my net check ended being $119. I went in to the controller and said I don’t understand what is Social Security and Medicare and I don’t understand who decided how much Federal and State tax would come out. So, he sat and explained it to me that social security was X % amount , Medicare was X % amount and those had to be paid. As for Federal and State there’s a really big formula and a very thick book that determines that.

So, he went over all of it with me which was really nice, and then I said “okay I guess what I have to do is just live on what the net is, not the $150 paycheck. I actually worked there 2 years, and right after Christmas in the New Year I received what was called a W-2.

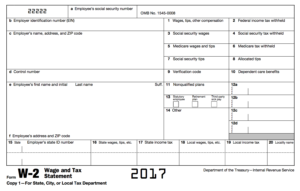

A W-2 is reported to the government about what you made in your paying job, remember that if you’re called an employee you will get a W-2. Now I don’t know how many of you, don’t open your W-2s but it’s really important that number 1 you look at your pay stabs every time you get them and at the end of the year you check out your W-2.

What your W-2 tell you is your gross wages, what your wages were before you got taxed, and then it will give you how much Federal tax you paid, how much social security you paid, how much Medicare you paid in and believe me if you’re like me I’ve been paying into those systems since I was 17 years.

So, there’s no way those are entitlements for me. Those are literally things that I’ve paid into for 48 years . So, I’m entitled to those things but those are not entitlements.

So, let’s go to the W-2 and it says these are your gross wages this is what you made before we took out the tax and now they have a box for Federal taxes and then they have a box for social security wages and Medicare wages.

If you live in a state like I do California where you get State tax it will also show you at the bottom how much state tax you paid and if you paid in to any disability programs if you have a 401K or a retirement plan, your W-2 is the thing that gives you the snap shot of your entire year.

Now, normally you get a W-2 at the end of January after the year closes, but if you quit your job in the middle of the year you would be allowed to ask for an interim W-2.